US Economic Outlook

There was uncertainty heading into 2024 with regards to whether economic activity would slow more substantially or continue to moderate gradually to achieve a “soft landing” after monetary policy had been more restrictive for longer than expected. Instead, economic growth and the labor market have surprised to the upside.

The Federal Reserve continued its cautious, data-driven approach to balance inflation and maximum employment. While inflation continued to moderate, it remained above the Fed’s long-term target of 2%. Meanwhile, the labor market remained strong but showed signs of cooling. In September, the Federal Reserve cut the Fed funds target rate by 50 basis points, acknowledging the progress on inflation and risks to continued economic and employment growth if the existing level of restrictive monetary policy remained in place. On average, the Federal Open Market Committee (“FOMC”) participants believed an appropriate target for the Fed funds rate would be 4.25%-4.5% by the end of the year, and 3.25-3.5% by the end of 2025.

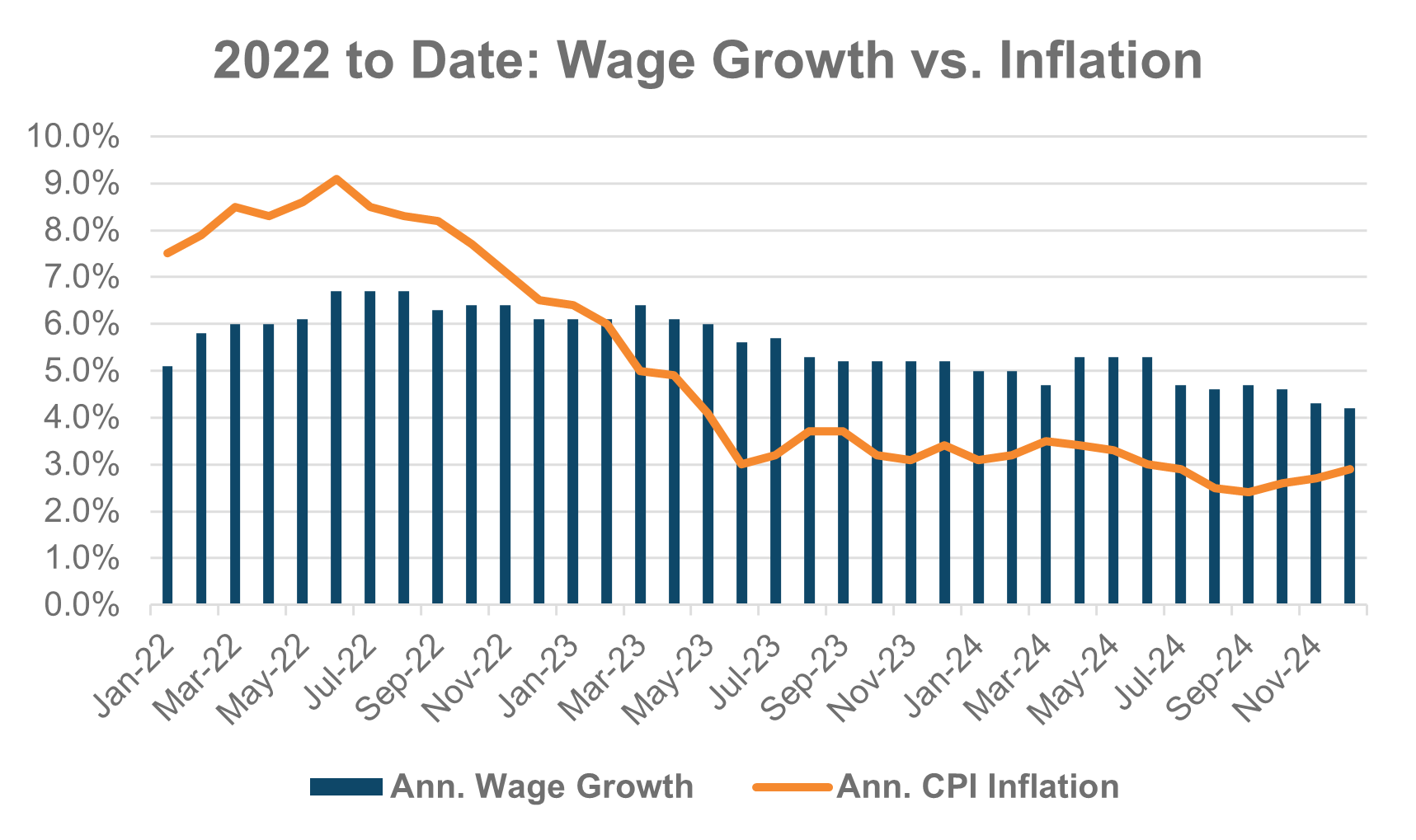

Since the September FOMC meeting, the US economy and labor market have surprised to the upside, closing out 2024 with strength. The labor market remained robust with the economy adding an average of 186,000 jobs per month, with December adding 256,000 positions. The unemployment rate has hovered around 4%, returning to pre-pandemic norms, while wage growth has outpaced inflation since early 2023. Inflation moderated over 2024 but remains elevated compared to the Fed’s long-term target of 2%. While goods inflation has eased, inflationary pressures remain in services because of labor shortages and wage gains.

While the Fed funds rate closed 2024 in line with the Fed’s September estimates at 4.25%-4.5%, the Fed has recalibrated its projection for rate cuts in 2025 given the strong fourth quarter economic data. In December, the Fed indicated an expectation of just 50 basis points of rate cuts in 2025, down from 100 basis points in September, which would bring the target Fed funds rate to a range of 3.75%-4.0% at the end of 2025.

Despite 2024’s strong economic performance, there is uncertainty regarding the 2025 economic outlook and corresponding monetary policy. The Fed will continue to monitor economic data as it seeks to balance the fight against inflation with maintaining maximum employment and continued economic growth. Although the year-end jobs report was strong, it is unclear if the same level of hiring gains and wage growth can continue. Consumer spending has continued to fuel the economy, driven by strong wage growth and the increasing use of credit. Wage growth and job openings have generally begun to slow throughout 2024. It is unclear how spending patterns would shift if the labor market cooled, and wage gains moderated relative to inflation. While election uncertainty has been eliminated, there are unknowns regarding the new administration’s potential policy changes to trade, immigration, taxes and the federal workforce.

The Commercial Real Estate Landscape

The commercial real estate industry has faced tremendous challenges between elevated interest rates, rising operating costs, and slowing revenue growth over the past several years. We expect these headwinds to persist, but moderate in 2025. Many asset types have seen significant new supply over the past few years, which has caused vacancy rates to rise and rent growth to decelerate. While new supply is expected to remain elevated in 2025, the pace of deliveries is generally expected to temper. Timing and magnitude will vary by asset type and market. Operating expenses, particularly labor, repairs and maintenance, utilities and insurance premiums, have also risen significantly over the last few years, eroding operating margins. While operating expenses remain elevated, the pace of increase has slowed.

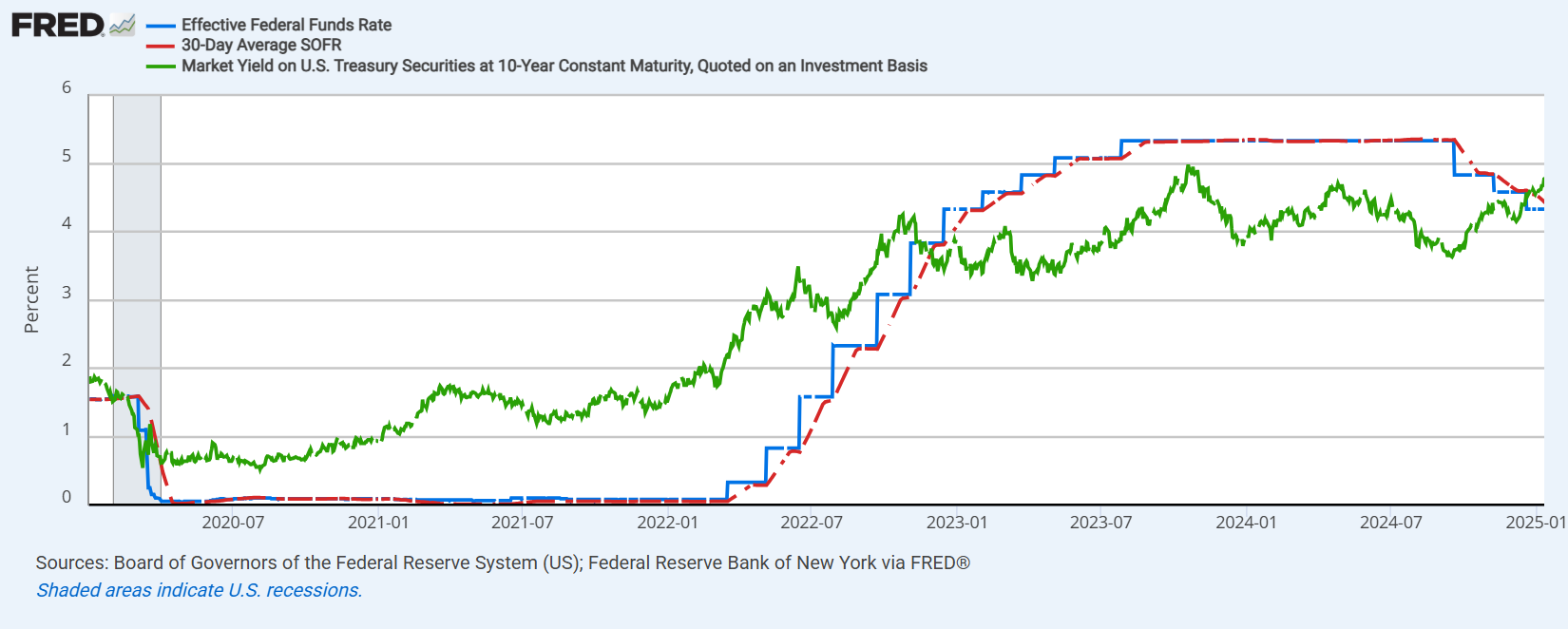

Interest rate cuts are still seen as the factor that will provide the most immediate relief for the commercial real estate industry since the rate tightening cycle began. As of the end of January 2025, the Fed funds rate and the floating rate index, SOFR, are still approximately 4.25% higher than before the rate tightening cycle. The 10-year Treasury yield, the common benchmark for fixed rate loans, is approximately 3.75%-4% higher compared to 2020 and approximately 3.0%-3.25% higher compared to 2021.

Although the Fed began cutting interest rates in September 2024, the 10-year Treasury yield, which had been declining since May 2024, started rising instead. The yield was 3.63% on September 16, 2024, the day before the Fed’s September FOMC meeting. Following the Fed’s subsequent rate cuts totaling 100 basis points from September through December, the yield on the 10-year Treasury increased by more than 100 basis points reaching a peak of 4.79% in mid-January before ending the month at 4.58%.

There is not a one-to-one relationship between the Fed funds rate and the 10-year Treasury yield. The Fed funds rate is a short-term rate set by the Federal Reserve and charged by banks to borrow from each other overnight. The 10-year Treasury yield is the interest rate the US government pays to borrow money for ten years and is considered to be extremely low risk. Importantly, it is a long-term yield. It is also a benchmark for long-term borrowing costs, including mortgages and corporate bonds. The US Treasury sells bonds via auction and yields are set through a bidding process. The 10-year Treasury price and yield are influenced by fiscal policy, investor expectations for economic growth and inflation, and to an extent, the Fed’s monetary policy. Yields tend to rise when confidence is high as there is less demand for a safe investment. Conversely, yields tend to fall when confidence is low as there is more demand for safe investments.

There has been significant volatility in the 10-year Treasury yield over the past two years as economic data has been mixed and there has been uncertainty surrounding economic growth, inflation expectations and monetary policy. The recent surge in the 10-year Treasury yield is driven by stronger than expected economic growth, the continued strength of the labor market, persistently elevated inflation, and the belief that the new administration’s potential policy changes could fuel economic growth, inflation, and deficits.

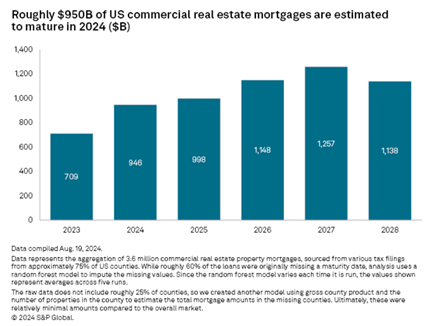

The spread between interest rates on maturing loans and new originations today remains a significant challenge for owners of commercial real estate. Average interest rates on mortgages originated in 2024 were nearly 200 basis points higher than mortgages maturing in 2024. Over the past two years, lenders have worked with borrowers on loan modifications that include maturity date extensions to give properties more time to improve NOI and avoid taking losses if forced to sell at initial maturity. An estimated $270 billion in loans were extended from 2023 to 2024. This trend will likely continue in 2025. While the volume of loan modifications, including maturity date extensions, has been substantial, it pales in comparison to the estimated $1 trillion of commercial real estate mortgages that are expected to mature in 2025. $4.5 trillion of commercial real estate mortgage maturities are expected over the next four years.

The wall of commercial real estate loan maturities could lead to acquisition opportunities. However, higher than expected short-term interest rates combined with the volatility and elevated yield on the 10-year Treasury could dampen transaction activity.

The Alpha Investing Strategy

We expect the 2025 interest rate and operating environments to remain challenging for commercial real estate. However, we continue to believe in the medium- to long-term fundamentals of commercial real estate. In particular, we believe senior housing and a targeted multifamily tax-abatement strategy to be compelling investment opportunities due to the strong asset fundamentals. We expect senior housing fundamentals to strengthen over the next few years due to demographic trends driving demand that is projected to materially outpace new supply. While multifamily has faced increased supply challenges over the last two years, it has also seen strong absorption, indicating demand for multifamily as homeownership costs remain prohibitively high.

We have continued to evaluate new acquisitions over the past few years since the onset of the rate tightening cycle, seeking to acquire fundamentally sound real estate with outsized upside potential relative to the downside risk. However, our transaction pace slowed significantly as few transactions have met our investment criteria. In general, cap rates and pricing haven’t adjusted sufficiently to offset interest rate increases, resulting in higher risk and reduced investor returns.

We remain disciplined in our acquisition targets to first and foremost guard against downside risk. To protect against the downside, we pursue investments that have high stable in-place yield and seek to use fixed-rate financing, when available, to mitigate interest rate risk. If fixed-rate financing is not available, we will purchase rate caps to fix the maximum interest rate, limiting our exposure to interest rate increases. In the current elevated interest rate environment, on our recent acquisitions financed with floating rate debt, we have purchased in-the-money rate caps, meaning our capped interest rates are below current market rates. Beyond financing, we look for investments that have a clear path for upside potential through revenue gains, expense savings or both. We believe our specific investment strategies within our target asset classes create the additional yield to offset higher interest rates without taking on additional risk.

Senior housing investments typically have higher yields due to the operationally intensive nature of the business. Additionally, operating margins are lower, which increases downside risk. Because of the operational complexities, there are fewer operators who can effectively manage this asset type. We continue to find acquisition opportunities in senior housing that meet our investment criteria when partnering with our experienced operator. We have seen in-place acquisition cap rates, or cap rates that can be achieved on “day 1” of ownership with an experienced operator, in the high single digits to low double digits. These yields are significantly better compared to other asset types. Many of these investments also offer the opportunity to further improve yield with the right business plan and operator.

While multifamily will face elevated supply headwinds over the next few years, demand remains strong. We believe our targeted multifamily tax-abatement strategy is compelling, as the tax abatement adds 100-200 basis points of yield, or value-creation, at acquisition. These investments are financed with 10-year, fixed rate debt, which provides holding power beyond the wave of new supply to capture the asset class’s strengthening fundamentals.

Across our entire portfolio, we remain focused on optimizing asset operations and improving NOI to maximize value. Like the broader commercial real estate sector, a subset of our existing portfolio has floating rate debt with near-term maturities. We continue to work to secure holding power for those investments through loan modifications and additional capital injections.