US Economic Outlook

For the past two years, the US economy has been in a holding pattern waiting for clarity on the trajectory of monetary policy. The Fed wanted the data to definitively signal that it was fulfilling its dual mandate of maximum employment and long-term inflation of 2%. Third quarter inflation readings were slightly below expectations, with August’s year-over-year PCE reading of 2.2% coming in very close to the Fed’s 2% price target. Furthermore, the labor market showed signs of cooling from its previous overheated state, with a slowing number of jobs added and a rising unemployment rate. As such, the Fed believed that the upside risks to inflation had lessened, while the downside risks to employment had increased, which paved the way for the monetary easing cycle to begin.

Inflation came in higher than expected at 2.7% in the beginning of the year, which sparked fears that it still had more room to run. However, second quarter data was in line with expectations and ended the quarter at 2.4%, while the third quarter has been headlined by August’s year-over-year PCE reading of 2.2%. Inflation has trended consistently lower since the beginning of the year, which has been the proof the Fed was looking for to feel confident that inflation was moving sustainably lower towards its target.

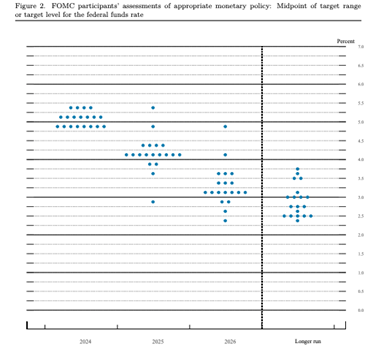

The labor market continues to exhibit signs that it is coming into a better balance over the course of this year. The number of jobs added has slowed from an average of 267,000 per month in the first quarter to 147,000 in the second quarter. At the time of the September Federal Open Market Committee (“FOMC”) meeting, the July and August job reports indicated an average of 128,000 monthly jobs added for the first two months of the third quarter. The Fed was pleased with the slack being absorbed in the labor market, but believed that as inflation was trending lower, there were risks of a further cooling labor market weakening economic activity and employment if the existing level of restrictive monetary policy remained in place. As a result, the Fed cut the Fed funds target rate by 50 basis points in September to a range of 4.75%-5%. On average, the FOMC participants believed an appropriate level of the Fed funds rate would be 4.4% by the end of the year, and 3.4% by the end of 2025, indicating another 50 basis points of rate cuts in the fourth quarter of 2024 and 100 basis points of rate cuts in 2025. These are the current estimates and remain subject to change.

Since the September FOMC meeting, the surprisingly strong September jobs report was released, showing the US added 254,000 jobs in the last month of the third quarter, sharply exceeding expectations for 142,500 jobs. Furthermore, July and August jobs were revised up, resulting in the third quarter averaging 186,000 jobs added per month. Additionally, the number of open jobs fell to the lowest level since January 2021 and unemployment remained healthy at 4.1%. While the strong September jobs report provides renewed confidence in the ongoing strength of the labor market, it may cause the Fed to recalibrate its pace of easing monetary policy. September PCE, which was also released following the September FOMC meeting, showed inflation increased 2.1% in the year, which is the smallest year-over-year increase since February 2021 and is only 10 basis points off from the Fed’s 2% inflation goal.

The timing and magnitude of future rate cuts remains unclear as the Fed will continue to make data driven decisions to ensure it does not undo its hard work of quelling inflation. Despite the uncertainty around the pace and magnitude of interest rate cuts, the inflection point has occurred and there is the expectation of easing monetary policy going forward.

The Commercial Real Estate Landscape

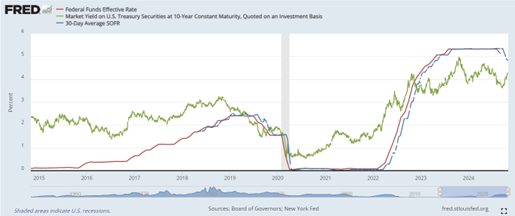

The commercial real estate industry has faced tremendous challenges between elevated interest rates, rising operating costs, and slowing revenue growth. Interest rate cuts have been viewed as a source of much needed relief for the industry since the rate tightening cycle began. However, the recovery will not happen overnight, as a 50-basis point rate cut will not undo the damage that has been done. As of the end of October, the floating rate index, SOFR, is still approximately 475 basis points higher compared to 2020 and 2021, impacting existing floating rate loans and new originations. Fixed rate loans are often benchmarked to the 5- to 10-year treasury rate. The 10-year treasury rate is approximately 350 basis points higher compared to 2020 and approximately 230 basis points higher than the average of the last ten years, before the Fed started hiking rates in 2022.

There is a record amount of commercial real estate debt maturing in 2026, while interest rates remain elevated compared to recent years. The spread between current interest rates and those of maturing loans will continue to impact owners’ ability to refinance existing loans and affect asset valuations, which could impact transaction activity.

Since the pandemic, properties have faced challenges from both higher interest rates and a more challenging operating environment. Higher interest rates mean higher borrowing costs. This has happened at the same time property operations have declined across the industry. Rising delinquency rates and lower occupancies have made growing revenue more challenging. Additionally, inflationary pressures have resulted in higher operating costs, which further squeeze NOI.

The combination of stagnant to declining NOI and increased borrowing costs have resulted in little to no free cash flow, or even negative cash flow, where the interest expense on debt exceeds the property’s NOI, necessitating capital calls to cover operational shortfalls. Lower property NOIs combined with rising cap rates, resulting from rising interest rates, have also materially lowered property valuations across the country.

On average, as of September, CRE values are down 19% from the peak in April 2022. Per the Green Street Commercial Property Price Index, property values bottomed out in January 2024 at a 21.6% decline from peak values. Property valuations have only marginally improved from the trough over the last nine months, which indicates that this will not be an overnight recovery. Multifamily values are, on average, still down 27% from recent peaks. Lower property valuations mean less value and even loss of equity value for current owners. For properties with maturing debt, the combination of lower NOI and lower property values means less debt proceeds available, which will require additional equity injections to complete refinancings to hold on to assets. Interest rates likely need to drop another 150-200 basis points for relief for properties acquired over the last several years.

The capital markets and operating environments are expected to remain challenging for owners of commercial real estate, despite the projected rate cuts. Operators need to remain focused on growing revenue, reducing vacancy, delinquency, and operating costs to maximize NOI. Distress is likely to continue over the next few years.

Multifamily

Multifamily real estate has been an incredibly popular investment vehicle over the past decade due to strong asset fundamentals. However, for the past few years, the asset class has faced slowing revenue due to the overhang and backlog from COVID-era eviction restrictions, softening economic conditions and increased supply, which have increased vacancy and put downward pressure on rent growth. Both delinquency and operating expenses have increased, and as a result, NOI has been difficult to grow, and in some cases has gone backwards. There is a growing number of distressed assets due to the prevalence of floating-rate debt and the sheer volume of debt originated over the past few years that are reaching maturity. More than $650 billion of multifamily debt is scheduled to mature between now and 2026. Multifamily is now the asset class with the second highest rate of distress, behind office. Operators face an uphill battle between still elevated interest rates, significant recent and upcoming new supply, and rising operational costs. Multifamily deliveries, which rose to a decades’ high in 2023, are expected to reach a 50-year high in 2024 and remain elevated through 2025.

Despite the challenges over the past few years, the medium-to-long term fundamentals for multifamily remain strong. Construction starts are declining due to financing costs, tightening construction credit and high construction costs. Multifamily deliveries are expected to drop significantly in 2026. Demand for multifamily remains strong driven by the high costs of homeownership. Mortgage rates remain elevated, while home prices continue to climb to record highs, driven by a significant decline in homes for sale and a shortage of new home construction. According to Redfin, only 2.5% of US homes were sold between January and August of 2024. That is a 37% decline from the same period in 2019. One of the main reasons for the decline in home sales is the lack of homes for sale. Only 3.2% of homes were listed for sale during that same period, the lowest level since at least 2012, the earliest year Redfin listing data is available. According to the Consumer Financial Protection Bureau, nearly 60% of mortgages have interest rates below 4%. While mortgage rates have fallen from recent highs of over 7.5% following the Feds’ September rate cut, the average 30-year fixed mortgage rate still stands at approximately 6.5%. The spread between homeowners’ existing low mortgage rates and current rates, combined with increasing home prices, creates a strong disincentive for existing homeowners to move or a “lock-in effect.”

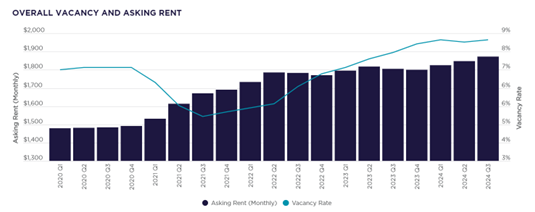

The lock-in effect will keep pressure on home prices, making homeownership unattainable for many Americans, particularly first-time homebuyers, driving demand for multifamily. 360,000 multifamily units were absorbed year-to-date through the third quarter, a 44% increase from 2023’s full-year total. The strong absorption has kept vacancy fairly stable at 8.7%, up only 20 basis points since the end of last year. After three years of vacancy increases and flattening or declining rents caused by the wave of new supply, vacancy appears to be stabilizing and rents increasing. Continued strong demand amidst a slowing delivery pipeline should put downward pressure on vacancy and upward pressure on rents over the next few years.

Senior Housing

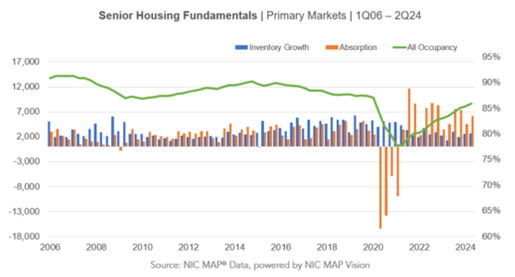

Senior housing has a more favorable near-term outlook as it has recovered from Covid-19 pandemic induced lows. Occupancy has increased for the thirteenth consecutive quarter to 86.5%, while rent growth remained intact, averaging 4.2% annual rent growth through the third quarter.

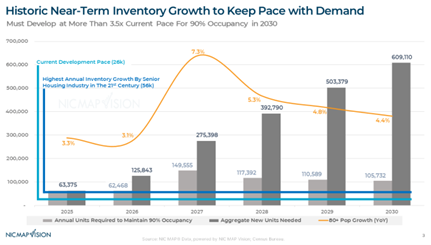

Furthermore, senior housing fundamentals are expected to strengthen over the medium- to long-term based on demographic trends. Absorption has surged to historic levels over the last two years, while inventory growth is 50% lower than the years leading up to the pandemic. Senior housing demand largely depends on the 80+ population, which is growing at four times the rate of the average population. Meanwhile, senior housing construction starts have fallen to near all-time lows due to higher interest rates, elevated construction prices, and limited capital availability.

Over the last two years and in the years ahead, the 80+ population growth is expected to materially exceed inventory growth. According to NIC MAP Vision data, there is expected to be a shortfall of over 550,000 units of senior housing by 2030 at the current development pace. Development would need to more than triple its current pace to keep up with demand in 2030.

Based on the near-term demographic trends and known supply pipeline, demand is expected to materially outpace inventory. As such, occupancy and rent growth are expected to be robust over the coming years. As inflation continues to normalize, senior housing operating margins are also expected to improve.

The Alpha Investing Strategy

The Fed’s September rate cut is a strong signal against further restrictive monetary policy. However, monetary policy remains in restrictive territory, as the Fed funds rate remains 4.75% higher compared to before the tightening cycle. The current operating and transaction environments remain challenged for commercial real estate. Although Alpha Investing has significantly slowed our transaction pace since the current rate tightening cycle began, we still believe in the medium- to long-term fundamentals of commercial real estate. In particular, we believe senior housing and a targeted multifamily tax-abatement strategy to be compelling investment opportunities due to the strong asset fundamentals.

We remain active on the acquisitions front, seeking to acquire fundamentally sound real estate with outsized upside potential relative to the downside risk. In the current high-interest rate environment, Alpha Investing has focused on acquisition targets that have maintained an attractive risk/return profile. This includes asset types and strategies that have high in-place yield with durable in-place cash flow, and utilizing fixed-rate financing, when available, to offer downside protection. While we are starting to see movement on cap rates, cap rates generally have not widened enough to offset interest rate increases. We believe it is highly unlikely that market cap rates will widen as much as interest rates have risen, resulting in reduced investor returns. Our specific investment strategies within our target asset classes, however, allow us to create that additional spread.

While the fundamentals for senior housing are strong, the asset class is an operationally intensive business with lower operating margins. The industry is still contending with recovering occupancy and higher operational costs, which have further reduced operating margins, and limited financing capital availability. Unlike most asset types, senior housing ownership remains fractured with many small mom and pop operators, who may lack the knowledge, ability or scale to successfully operate in today’s challenging environment.

We continue to find opportunities in senior housing that meet our investment criteria when partnering with our experienced senior housing operator. We have seen in-place acquisition cap rates, or cap rates that can be achieved on “day 1” of ownership with an experienced operator, in the high single digits to low double digits. These yields are significantly better compared to other asset types and offer strong in-place cash flow with the opportunity to further improve yield with the right business plan and operator.

While multifamily will face elevated supply headwinds over the next few years, demand remains strong. We believe our targeted multifamily tax-abatement strategy is compelling, as the tax abatement adds 100-200 basis points of yield, or value-creation, at acquisition. These investments are financed with 10-year, fixed rate debt, which provides holding power beyond the wave of new supply to capture the asset class’s strengthening fundamentals.

Like the broader commercial real estate sector, a subset of our existing portfolio has floating rate debt with near-term maturities. We continue to work to secure holding power for those investments through loan modifications and additional capital injections. Across our entire portfolio, we remain focused on optimizing asset operations and improving NOI to maximize value.