Q2 2020

More than halfway through 2020, the coronavirus continues to spread across the world, with over 17 million confirmed cases worldwide. The health and economic impacts have been particularly acute in the US, which is now the epicenter of the pandemic, with over a quarter of reported global infections. In late March and early April, state and local governments took the unprecedented step of banning large gatherings and shutting down non-essential businesses and schools in an effort to contain the spread of the virus and prevent healthcare systems from getting overwhelmed. While the shutdown was successful in flattening the curve in initial hotspots, it came at a high economic cost, and unfortunately, failed to effectively contain the virus due to inadequate widespread testing and lax social distancing enforcement. Furthermore, eager to jump start the economy, many states proceeded with reopening, despite not having met the criteria recommended by the White House and CDC. As a result, the US has seen a sharp uptick in daily new cases rising to 70,000 at the end of July, which is more than double the new cases in June, and also March and April, when the economy was shutdown. The surge in new cases has many states pausing reopening plans, putting a halt to the short-lived recovery. Ultimately, the timing and magnitude of a sustained economic recovery will depend on our ability to effectively manage and contain current and future virus outbreaks.

Market Update

After a record-setting 128 months of economic expansion, the US entered a recession in February, as the coronavirus pandemic brought economic activity to a standstill. First quarter GDP contracted at an annualized rate of 5%. Second quarter GDP is estimated to have plunged at a 33% annual pace, representing the worst decline in recorded history. With businesses shut down, the unemployment rate began to rise in March, and more than tripled in April, jumping to 14.7%. This represents the highest rate and largest month-over-month increase in the history of the available data dating back to 1948. As states started easing restrictions in May and June, the economy regained 7.5 million jobs, causing the unemployment rate to fall to 11.1% and weekly new unemployment claims to decrease from 6.8 million at the end of March to 1.3 million in mid-July. While a step in the right direction, the unemployment rate remains worse than any time since the Great Depression and the number of new unemployment claims are still nearly double the pre-COVID high of 695,000 recorded in 1982.

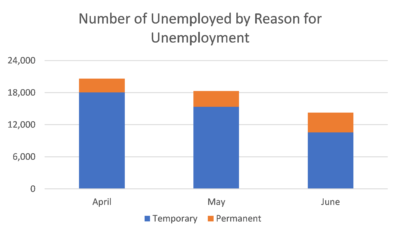

As states pause or rollback reopening plans, those gains are already starting to reverse. New unemployment claims increased in the week of July 18 for the first time in nearly four months. Furthermore, the longer businesses remain closed, the greater the risk of job losses becoming permanent. In April, 18.1 million layoffs were considered temporary job losses (people expecting to return to work within 6 months), while 2.6 million job losses were considered permanent. Although the total number of unemployed has declined, the number of permanent losses has continued to rise, reaching 3.7 million in June. Permanent layoffs represented 26% of jobs lost in June, up from 12% in April.

In response to the health crisis, in March, Congress passed the Coronavirus Aid Relief and Economic Security (“CARES”) Act, a $2.2 trillion stimulus package that provided support to individuals, businesses, and state governments. Some of the relief measures for individuals included a one-time payment of up to $1,200 to over 150 million eligible families and individuals, expanded unemployment coverage to individuals previously not eligible such as self-employed and gig workers, an additional $600 per week in unemployment benefits, and protections against evictions and foreclosures on properties with federally backed mortgages.

At the end of July, both the expanded federal unemployment assistance along with the temporary eviction moratorium will expire, while the US still faces record-high unemployment and struggles to contain the coronavirus causing the economic disruption. The House of Representatives and Senate have each released their proposals for a second stimulus package. However, with negotiations ongoing, it is becoming increasingly likely that there will be a lapse in benefits that would result in declining incomes for millions of unemployed Americans. The Bureau of Economic Analysis (“BEA”) estimates that the extra $600 in weekly unemployment boosted incomes by $842 billion in May (expressed at an annualized rate), which represents 14.6% of total wage and salary income. Historically, unemployment insurance has represented between 0.3% and 2.0% of total wage and salary income in the US. The current jump in percentage is reflective of the vast number of people that are unable to work due to the pandemic.

The one-time stimulus checks combined with enhanced unemployment benefits are credited with supporting consumer spending and assisting out of work Americans in meeting rent payments. In the National Multifamily Housing Council’s (“NMHC”) survey of 11.5 million multifamily units across the country, 91.3% of apartment households made a full or partial rent payment through July 20. That compares to 92.2% paid by June 20 and 93.4% paid through July 20, 2019. While the July payment rate is down from both a month and year prior, it is only slightly behind. However, if the additional unemployment assistance is not extended, it is likely many vulnerable renters will have more difficulty with future rent payments and other expenses.

Consumer spending has been the backbone of the US economy, accounting for nearly 70% of GDP. In the first quarter, consumer spending fell at an annualized rate of 6.8%, driving the 5% decline in GDP. Personal consumption declined 12% or $1.5 trillion in April, following a 6% or $860 billion decline in March. At the same time, the personal savings rate, which increased steadily from 3% to 8% following the Financial Crisis, reached a historic high of 32% in April. While some Americans may be prudently shoring up on reserves given the uncertainty surrounding employment and further federal assistance, others are in a position of “forced savings”, where they would happily spend on goods and services if those businesses were open and consumers felt safe patronizing those stores. How much money American consumers spend and when they are willing and able to spend that money will have significant implications for the recovery of businesses and the greater economy.

Businesses are seeing a historic wave of bankruptcies brought on by the pandemic and falling consumer demand. A few large retailers made headlines in recent weeks with bankruptcy declarations, but they were far from alone in this trend, as a growing number of companies, big and small, struggle and are forced into bankruptcy. According to Epiq, nearly 610 companies filed for Chapter 11 in June alone, representing a 43% increase over June 2019. In the first half of 2020, over 3,600 companies filed for Chapter 11, up 26% compared to the same period in 2019.

There is a significant amount of uncertainty in the economic outlook as the path to recovery is dependent on a multitude of factors. At the center of the uncertainty is the amount of time it takes the US to effectively contain the spread of the coronavirus. While researchers and pharmaceutical companies worldwide have raced to develop a vaccine, vaccines historically have taken more than ten years to develop. Even in a best-case scenario, we are likely still 12-18 months away from having a widely available, safe and effective vaccine. During that time, the policies and actions of governments, businesses and individuals will determine whether the virus continues to spread or gets reined in.

Alpha Investing Strategy

Commercial real estate activity plummeted in the first half of 2020 with both transaction volume and value declining 50% compared to first half 2019. Economic uncertainty and tightening credit contributed to this decline.

We believe opportunities to earn attractive risk-adjusted returns remain in commercial real estate. Additionally, private real estate historically has a low correlation with public equities. The low correlation can provide a greater degree of diversification to an investor’s portfolio, which may be valuable amidst the highly uncertain circumstances we presently face.

On the acquisition front, we have resumed evaluating new deals. Our strategy to target recession-resilient asset classes in markets with strong employment and population growth remains. Out of our preferred asset classes, multifamily and senior housing have so far shown to be more resilient during the current downturn compared to other asset types, such as hospitality and retail. Our previous belief in student housing’s resiliency has been upended by the pandemic-induced down-market, which has resulted in campus closures and the move to online learning. Student housing has historically been the smallest segment of our preferred asset classes, and in the short-term, we are less likely to consider opportunities in this asset class.

For new acquisitions, we remain disciplined in underwriting and diligence and are presently focused on investments with durable in-place cash flow, which we view as an element of downside protection. Given the current environment and potential near-term economic challenges, we have adjusted our views on what scenarios constitute as “downside”. We are generally looking for investments that can absorb approximately 25% of economic vacancy and little to no rent growth over the next 12 months. The majority of investments we evaluate do not meet these criteria, so we remain patient until we find these opportunities. We recently raised for an investment that closed at the end of July that had strong in-place cash flow and an attractive risk-adjusted return.

Alpha Investing Portfolio

To date, Alpha Investing has participated in 39 transactions across the United States, as well as a commercial real estate debt fund. The total capitalization of the 39 transactions in our portfolio is over $1.45 billion.

Recent Transaction:

Multifamily Acquisition

Chicago, Illinois

- Off-market acquisition of an affordable housing portfolio at an 8.3% projected Year 1 acquisition cap rate

- Portfolio is 98% leased with 70% of in-place rental revenue paid for through the Chicago Housing Authority’s (“CHA”) Housing Choice Voucher program, which pays a portion of eligible families’ rent each month directly to the property owner

- The properties were significantly renovated prior to acquisition, with the seller infusing $25,000 – 45,000 per unit to update interiors and exteriors and cure deferred maintenance

- Experienced sponsor and local property manager who currently manages over 3,000 affordable housing units in the South Side of Chicago and has a strong relationship with the CHA