US Economic Outlook

Over the first half of 2023, the US economy has remained resilient despite high interest rates and elevated inflation. The labor market has remained strong with low unemployment, robust job growth, and steady wage growth. However, there are signs that the Fed’s monetary policy is cooling the economy and bringing the labor market, which skewed in favor of workers during the recovery, back into balance.

While job growth has continued, the pace has slowed, and job openings and wage gains have receded from historic highs. Furthermore, government hiring, predominantly at the state and local levels, has progressively made up a larger percentage of the monthly new jobs. The government has been on a hiring spree to replenish the jobs that were shed during the pandemic. Strong job gains from the government have been offsetting weakening job creation in the private sector.

Consumer spending has remained at healthy levels, buoyed by the strong labor market and record stimulus, but it too has slowed. There are signs that sustained high inflation, which has outpaced wage growth, is straining consumers. Credit card debt has increased 17% from a year ago to nearly $1 trillion, while the personal savings rate has dwindled to 4.6%, or approximately half of the decades-long average of 8.9%. Furthermore, the student loan forbearance program is set to expire in September after a nearly four-year pause, which will add more stress to consumers.

The June inflation reading of 3% represents a significant improvement since the Fed began this tightening cycle. However, it is still 50% higher than the Fed’s long-term goal. Additionally, core CPI, which excludes food and energy, rose 4.8% and has been slower to come down. The Fed has been cautious to not prematurely declare victory over inflation, particularly considering the strength of the labor market and has not ruled out additional rate hikes in the second half of the year to bring inflation in line with their target of 2%.

At the moment, it appears a “soft landing” is possible as inflation has cooled significantly since the beginning of this tightening cycle, while the labor market remains strong. However, while the Fed has slowed the pace of interest rate hikes, interest rates remain elevated and will continue to weigh on consumers and businesses.

The Commercial Real Estate Landscape

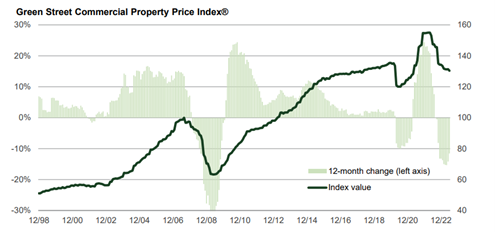

Commercial real estate pricing is down 16% overall since prices peaked in 2022 and transaction volume is down 70% year-over-year in Q1[1]. Sales volume continues to be hampered by high financing costs. Additionally, declining asset values have led to less willing sellers and continued bid-ask spreads between buyers and sellers. Owners who do not need to sell will hold their assets and wait for a more favorable exit environment.

[1] Source: Green Street

While commercial real estate continues its repricing, there is a wave of debt maturities that are coming due over the next several years. There is approximately $1.2 trillion of outstanding commercial and multifamily mortgages maturing in 2024 and 2025[2]. Owners will be seeking to refinance into a very different capital markets environment with dramatically higher interest rates than previously anticipated. Between high interest rates and value declines, refinance proceeds may be limited by minimum debt service coverage requirements and maximum leverage constraints. Additional capital, in the form of equity, preferred equity or mezzanine debt, will be required to fund the gap between the maturing loan balance and refinance proceeds. Owners who are not able to secure a new loan or otherwise repay the existing loan will be forced to sell.

So far, lenders have generally been amenable to working with borrowers when they see the medium- to longer-term value of the real estate and the borrowers committed to the asset and business plan. Oftentimes, this requires owners to have cash reserves to improve and operate the property. Not all borrowers and lenders will reach agreements on loan modifications or workouts, which will lead to some forced sales. As of June, the delinquency rate for commercial mortgage-backed securities has risen to 3.9%, the highest rate in 14 months.

The near-term economic uncertainty combined with high interest rates has continued to make operating assets more difficult. Properties financed with floating-rate debt have experienced a sharp increase in debt service costs that have eaten into cash flow. Maturing fixed-rate debt will be faced with a higher interest rate at the time of refinance. Owners and operators need to grow net operating income to keep pace with rising borrowing costs and have capital available for reserves to fund operating shortfalls and other property needs. While property values have declined due to rising interest rates, commercial real estate fundamentals generally remain sound. Owners who can maintain holding power will be able to sell into a more favorable environment and optimize value.

[2] Source: Mortgage Bankers Association

The Alpha Investing Strategy

Alpha Investing continues to believe in the fundamentals of investing in commercial real estate. However, the asset class faces near-term operational challenges and an unfavorable capital markets environment. Economic uncertainty has resulted in weaker demand and rising delinquencies, which has reduced revenue growth. At the same time, operating expenses and borrowing costs have risen, which has led to reduced margins and cash flow. While the pace of interest rate hikes has tapered, interest rates remain at elevated levels.

Alpha Investing believes there are strategies to navigate the current environment. On our existing portfolio, we are focused on ensuring we have the necessary holding power to position all assets to exit at a more favorable time. Growing net operating income through lease-up, market rent growth, value-add growth and expense reductions, and bolstering capital reserves are imperative to creating holding power.

For new acquisitions, we continue to focus on investments that have durable, in-place cash flow where the going-in yield is higher than the cost of debt. We are generally using lower leverage compared to 2021 and 2022, and our preference is to acquire assets using fixed-rate financing. Where fixed-rate financing is unavailable or not optimal at acquisition, we will seek to purchase rate caps for floating rate debt to lock in the maximum cost of borrowing at acquisition.

We remain active on the acquisitions front, seeking to acquire fundamentally sound real estate with outsized upside potential relative to the downside risk. We will continue to target the strategies mentioned above, which we began employing during the second half of 2022. With asset pricing declining from prior cycle peaks, we believe there may be opportunities to acquire distressed assets stemming from debt maturities, hold period limitations, or ineffective management. However, with the sharp rise in interest rates, oftentimes the reduction in price is not large enough to offset the impact of higher interest rates. We remain disciplined in our underwriting, focusing on asset fundamentals and downside protection and we will be patient for the right opportunities.