US Economic Outlook

Second quarter inflation data based on PCE shows progress towards the Federal Reserve’s long-term inflation objective. Strong first quarter inflation readings were higher than expected and sparked fears that inflation had not cooled sufficiently. However, second quarter monthly inflation readings were in line with expectations, headlined by June’s year-over-year PCE reading of 2.5%. Recent inflation data has renewed optimism that inflation may finally be moving towards the Fed’s long-term target of 2%, which would clear the way for a less restrictive monetary policy.

The labor market remains solid but is showing signs of cooling. The number of jobs added slowed from 276,000 per month in the first quarter to 177,000 per month in the second quarter. The number of jobs added was in line with expectations, but job gains continued to be dominated by just a handful of sectors. Two-thirds of job gains in the second quarter came from education and health services and government. The unemployment rate ticked up to 4.1% in June, ending its record streak of being 4% or lower, but remains low by historical standards. The slowdown in hiring and rise in unemployment continued in July, with only 114,000 jobs added, well short of economists’ estimates of 175,000, and unemployment rose to 4.3%, the highest level since October 2021. The cooling labor market has resulted in slower real wage growth, which reduces consumer purchasing power.

Consumer spending decelerated from 3.3% in the fourth quarter of 2023 to 2.5% in the first quarter of 2024. Although consumer spending has tempered, it does not appear to be a concern yet, as it is moving closer to historical levels. However, there are signs the consumer is more stressed. In the first quarter, aggregate household debt balances increased to $17.7 trillion, which is a $3.5 trillion increase from pre-pandemic levels at the end of 2019. Delinquency transition rates are also on the rise. Over the last year, 8.9% of credit card balances and 7.9% of auto loan balances transitioned into delinquency. The US economy is heavily reliant on consumer spending. Further cooling of the labor market and deterioration of consumer finances could result in less consumer spending.

At the beginning of the year, the Fed had signaled the possibility of three rate cuts over the course of 2024. Strong job growth and inflation in the first quarter, however, raised doubts around the timing and amount of interest rate cuts this year. Current reports indicate continued easing of inflation and a moderating labor market with tempering job growth and wage gains. This is the data the Fed has been waiting to see before easing the current restrictive monetary policy. The question remains, how much data does the Fed need to see before cutting interest rates. The Fed left its benchmark rate unchanged at 5.25-5.5% in its July meeting. Further softening of the labor market will put increasing pressure on the Federal Reserve to reduce interest rates.

The Commercial Real Estate Landscape

Commercial real estate continues to be weighed down by elevated interest rates. The Fed Funds rate has increased by 525 basis points over the course of 16 months beginning in March 2022 and has stayed at 5.25-5.5% for a year. The sharp rise in interest rates caused a steep drop in transaction volume in 2023 and year-to-date 2024.

Investments financed with floating rate loans felt the impact of rising interest rates immediately. Interest expense on floating rate debt without rate caps effectively doubled to tripled with the 525 basis point increase in interest rates. Although interest rate caps, which cap interest rates at predetermined values, are purchased for most floating rate debt, the duration of rate caps is typically shorter than the term of the loans. The result is floating rate debt with rate caps in-place were shielded from the impacts of the interest rate hikes throughout the term of the rate caps. However, many rate caps have expired during the nearly two and a half years that interest rates have remained elevated. The cost of purchasing new rate caps in an elevated interest rate environment has increased significantly. These factors combined have caused struggles for properties with floating rate debt over the past two years. As of June, the distress rate for CLO loans, which are backed by shorter-term, floating rate loans for transitional financing, reached 9.74%.

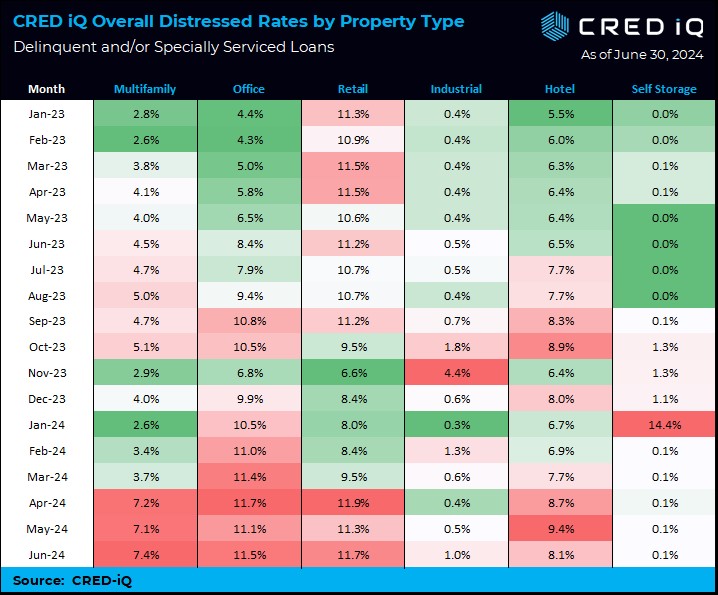

However, strains are spreading beyond floating rate loans the longer interest rates remain elevated. Properties with debt maturing, whether fixed rate or floating rate, are facing a difficult sale and refinance environment and are showing signs of increased distress. The distress rate for all property types with CMBS loans, which are backed by longer-term fixed rate loans, increased to 8.62% in June, the fourth consecutive month of rising CMBS distress rates. Although the highest CMBS distress rates remain office and retail, multifamily distress has surged in recent months, increasing 185% over the last six months, from 2.6% in January to 7.4% in June. The increase in CMBS distress demonstrates the widespread impact of higher interest rates throughout commercial real estate.

The rising distress rates come at a time when lenders and borrowers are working through a significant amount of loan modifications that extend or modify existing loans. The distress rate in absence of loan modifications would be higher. The Mortgage Bankers Association estimates that $929 billion of commercial real estate loans are maturing in 2024, up from a previous estimate of $659 billion, due to loan extensions and modifications lenders have granted. While loan extensions and modifications are continuing at an elevated rate, they are just temporary relief measures until interest rates come down.

Transaction volume remains muted, which is likely due to record amounts of loan extensions and modifications, and continued bid-ask spreads between buyers and sellers. First quarter 2024 trailing four-quarter transaction volume of $339 billion was the lowest total since the second quarter of 2013. Rising distress levels could lead to increased transaction volume in the coming quarters. However, there is also the chance that delinquency rates do not increase much in the coming quarters due to continued loan workouts.

The Alpha Investing Strategy

The current operating and transaction environments remain challenged for commercial real estate. While Alpha Investing has significantly slowed our transaction pace since the current rate tightening cycle began, we still believe in the medium- to long-term fundamentals of commercial real estate, particularly for senior housing and a targeted multifamily strategy.

These asset sectors continue to have favorable supply and demand fundamentals. Demand for senior housing is growing as the aging population in the US is rapidly expanding. Senior housing supply has been constrained by elevated costs and lack of financing. Despite the elevated supply of multifamily in 2023 and expected through 2025, a shortage of affordable housing remains. According to a Bankrate study, the average annual cost of owning and maintaining a single-family home is 26% higher today compared to four years ago. The high cost of home ownership driven by rising home prices and higher mortgage rates continues to drive the demand for multifamily.

We remain active on the acquisitions front, seeking to acquire fundamentally sound real estate with outsized upside potential relative to the downside risk. In the current inflationary and high interest rate environment, Alpha Investing has focused on acquisition targets that have maintained an attractive risk/return profile. This includes asset types and strategies that have high in-place yield with durable in-place cash flow, and utilizing fixed-rate financing when available, to offer downside protection. These opportunities are not common in today’s elevated interest rate environment. With interest rates remaining in restrictive territory, many transactions have negative leverage due to interest rates moving more sharply compared to price reductions. We remain disciplined in our underwriting, focusing on asset fundamentals and downside protection and will be patient for the right opportunities.

We continue to find opportunities in senior housing that have met our investment criteria when partnering with our experienced senior housing operator. We have seen acquisition cap rates in the high single digits to low double digits. These yields are significantly better compared to other asset types due to the operational intensity and fractured ownership of the sector. These transactions offer strong in-place cash flow with the opportunity to improve yield with our experienced senior housing operator.

Like the broader commercial real estate sector, a subset of our portfolio has faced the challenges associated with having floating rate debt with near-term maturities. For these investments, we are focused on securing holding power through loan modifications and additional capital injections, whether from existing investors or third parties. Across our entire portfolio, we remain focused on optimizing asset operations and improving NOI to maximize value.