Investing in Senior Housing: A Strategic Guide for Real Estate Investors in 2024

As the U.S. economy navigates through a period of high inflation, rising interest rates, and slower economic growth, the senior housing market has emerged as a resilient asset class offering a blend of real estate, healthcare, and hospitality. With the aging U.S. population driving increased demand for various types of senior living arrangements, this sector presents a unique opportunity for real estate investors. This article delves into the spectrum of senior housing options and the key economic factors investors should consider in today’s environment.

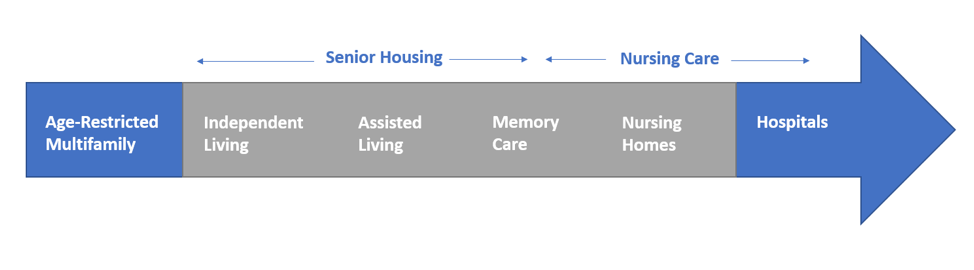

The Spectrum of Senior Housing

Senior housing encompasses a wide range of options, each catering to different levels of care and lifestyle preferences. Understanding this spectrum is crucial for investors, as each type of facility presents unique operational and financial characteristics, particularly in the current economic climate. Alpha Investing generally prefers to acquire need-based senior housing assets lower on the acuity scale – specifically independent living, assisted living, and memory care – avoiding skilled nursing and hospitals.

- Age-Restricted Multifamily: Serving those aged 55 and older, these properties include single-family rentals, apartments, and townhouses. Rental fees generate the bulk of the revenue, with additional income from services like transportation and community activities. Given that mortgage rates have reached over 7% as of mid-2024, many seniors are opting to rent rather than buy, creating more demand for this product type. Despite being described as senior housing, age-restricted apartments are operated much more like traditional multifamily assets – i.e., without the need for specialized operations.

- Independent Living: Similar to age-restricted housing but with more extensive amenities, such as dining services and organized activities. This category benefits from the broader trend of older adults seeking convenience and community without the burdens of homeownership, especially as consumer confidence remains cautious amidst economic uncertainty. Independent living is typically thought of as the first step in need-based housing for seniors, as residents need some amount of support.

- Assisted Living: These facilities offer support with daily activities and require licensing to provide medical care. In 2024, the rising costs of healthcare and the regulatory environment have made operator efficiency and expertise even more critical, as operating margins are squeezed by higher labor costs and inflation. Assisted living is need-based and will typically involve care by nurses.

- Memory Care: Specialized facilities for residents with cognitive impairments like Alzheimer’s. As the U.S. population over 65 continues to grow—projected to reach 80 million by 2040—the demand for memory care is expected to increase significantly, presenting a robust opportunity for investors.

- Skilled Nursing Facilities: These provide intensive medical care and are heavily regulated. With healthcare inflation running at 5% annually, these facilities face rising costs, but they also benefit from steady demand as the aging population requires more advanced medical care.

Hospitals: Representing the highest level of care in the spectrum, hospitals often collaborate with skilled nursing facilities for patient transitions. Given the current strain on the healthcare system, including staffing shortages and higher operational costs, these institutions are under financial pressure, but they remain essential components of the senior care continuum. The spectrum of senior housing operations, with acuity of required care increasing from left to right.Age-restricted multifamily properties are usually for those aged 55 and older. Units can range from single family rentals to apartments and townhouses. Most revenues are generated by rental fees, with a slight premium added for special activities and amenities, such as a shuttle bus for those who prefer not to drive.

The spectrum of senior housing operations, with acuity of required care increasing from left to right.Age-restricted multifamily properties are usually for those aged 55 and older. Units can range from single family rentals to apartments and townhouses. Most revenues are generated by rental fees, with a slight premium added for special activities and amenities, such as a shuttle bus for those who prefer not to drive.

Independent living facilities are similar to age-restricted housing. In addition to many of those same optional conveniences, independent living facilities tend to cover more programming and amenities, such as restaurant-style dining. Assisted living facilities are one step up, providing additional service/assistance with activities of daily living, such as eating and bathing. Assisted living facilities are regulated and must be licensed to provide medical care.

Memory care communities are designed for those with memory-loss issues. They are often integrated with independent living and assisted living communities, as some service staff can share similar competencies, but Memory Care can also be provided on a standalone basis. The most intensive senior housing are skilled nursing facilities, which are similar to traditional nursing homes. Similar to Assisted living facilities, Memory Care & Skilled Nursing facilities are regulated, and require a licensed operator to provide medical care. There also may be physical requirements of the buildings housing patients, for the safety and well-being of the members of the community.

Although there are several different types of senior housing, the general economic principles described below apply to all.

The Economics

When evaluating senior housing opportunities, it is important to first understand that senior housing is an operating intensive business that is heavily regulated, making the operator’s experience of utmost importance. We take a look at this in more detail below, as well as some of the additional underlying economics that can influence the profitability of an investment:

Experienced Operator

While senior housing is a real estate asset class, it is also a local operating business. The experience of an operator is critically important to the successful operation of a facility (and thereby, the success of an investment) and sets the tone for prospective investors looking to place capital in a deal.

An operator has many tasks. For one, senior housing is a heavily regulated industry, and as a result, demands a high-quality operator who understands the nuances of these regulations in order to remain in compliance.

Another role of the operator is in attracting, training, and retaining the staff who run the facility, as labor is one of the largest operating expenses in senior housing. Operators must also have strong systems, policies, and procedures in place to ensure resident safety and compliance with laws, while simultaneously creating a warm and caring environment that is appealing to customers (minimizing vacancy).

While good operations for any property is important to the investment’s success, operator risk to senior housing is magnified compared to other commercial real estate asset classes. For a senior housing project to achieve its full potential, it must have an operator with a detailed understanding of both local regulations, and the nuances how to operate and manage a senior housing facility.

Demand Composition

Gut instinct may tell you to start by evaluating local demographics to understand aging trends, as one might initially believe that an area that has a high concentration of aging adults would be a logical place to invest in senior housing. Demand is more nuanced than that, though. Demand for senior housing is actually most often driven by the location of seniors’ adult children, who often become the critical decision maker as it pertains to whether their parent(s) will move into a senior living facility. Investors should consider both age cohorts (those aged 45 to 64, and those aged 65 and above) when evaluating potential demand for senior housing.

Demographics

Most senior housing investors will want to look at the demographic profile of those living within a five- to ten-mile radius of the subject property. Some of the most critical demographic information to collect within that trade area includes:

- Number of Seniors & Population growth projections

- Median household income of seniors living independently

- Median household income of adult children

- Local housing values, as this tends to be a good proxy for wealth

Typically, you’ll want to know how many households earn above a particular income threshold (such as $100,000 or $150,000) and whether this demographic is increasing or declining within the local trade area.

Sources of Rental Payments

It is also critical to understand the likely source of rental payments for senior housing occupants. Depending on the nature of the senior housing complex, the monthly rental payments can exceed well over $10,000 – this is particularly true as you move up the spectrum to memory care and skilled nursing facilities. That said, the national median household income for those aged 75 and above is under $30,000. For many, income alone is not enough to cover the costs of rent and services for the average senior housing unit.

Assuming most seniors will be collecting Social Security benefits, and assuming this will be insufficient to cover the full costs of senior housing – where does the additional income come from? This is a critical piece of the due diligence investors must do before investing in senior housing. Aside from income, what other household assets may be contributed? This may include money from savings accounts, stocks, bonds, retirement accounts, the sale of real estate assets, vehicles, and more. Seniors may also have long-term care insurance policies. Others, still, may receive financial support from their adult children.

In short, you want to know what portion of the rent payments will be provided through Medicaid versus private-pay residents. Among the private-pay residents, it’s important to understand whether the target demographic in a given market can support the rental payments through any combination of the income and assets described above.

Market Competition

Most seniors want to either age in place, or age in a community close to their families. They don’t want to move hundreds of miles away. As such, it’s important to look at competition within your specific submarket. What type of care/facilities are offered? Are there gaps in what exists today? What are the comparable market rents at other local facilities? What are competitors’ occupancy ranges? How many units or beds does each location have? Answering these questions will help you better understand your submarket competition.

Conclusion

The senior housing sector was once considered a specialty asset class but in recent years it has become a more mainstream product type that is attracting attention from individual and institutional investors alike. With Americans living longer than ever before, there’s no reason to believe that interest in senior housing will slow down. Understanding the economics of senior housing is a critical first step for anyone looking to add senior housing to their investment portfolios.