US Economic Outlook

Inflation was markedly higher in the first quarter of 2024 after moderating in the second half of 2023. Core Personal Consumption Expenditures rose by 3.7% on an annualized basis, compared to 2% last quarter, and was the largest increase in twelve months. Meanwhile, economic growth of 1.6% underperformed estimates and was the slowest growth rate since the second quarter of 2022.

The labor market remains tight with the unemployment rate remaining below 4% for the 27th consecutive month, tying the longest streak in the 1960s. First quarter job growth exceeded economists’ predictions, boasting average monthly gains of 276,000. The continued strong labor market has produced wage gains that have outpaced inflation, leading to increased purchasing power for consumers.

April saw a slowdown in hiring with 175,000 jobs added, led by a pullback in government hiring. After trailing the private sector in job recovery following the pandemic, government hiring has been driving strong job gains since 2023. In 2023 and the first quarter of 2024, government hiring represented nearly 25% of all job hires, while it made up only 11% in 2019. A reversion of government hiring to its pre-pandemic levels could temper the robust job market.

Consumer spending, while strong, is decelerating as inflation continues to eat into wage increases. Consumers have dug into savings and taken on record levels of debt to maintain consumption patterns. The personal savings rate has decreased to 3.6% in the first quarter, from 4% in the fourth quarter of 2023, while household debt reached $17.5 trillion. Consumer spending drives the economy and job creation. Reduced consumer spending could lead to a pullback in job creation.

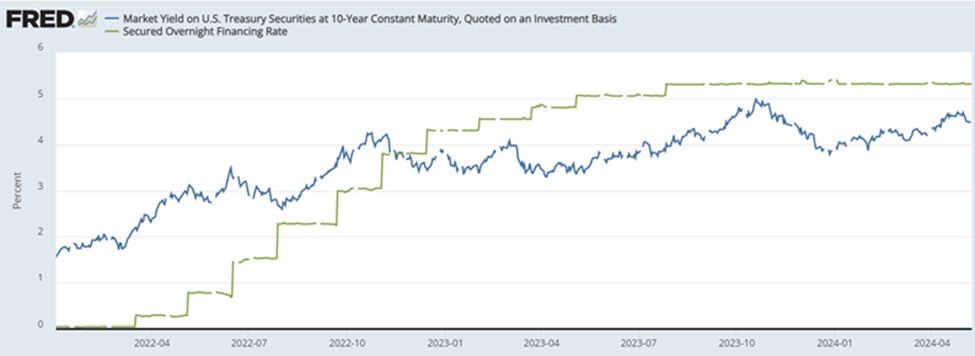

Going into 2024, the Fed had signaled the possibility of three rate cuts over the course of the year. Some economists expected the first rate cut starting as early as March. However, with first quarter inflation data coming in stronger than expected and higher than the Fed’s long-term target of 2%, combined with a strong labor market, the Fed kept the federal funds rate unchanged at 5.25-5.5% in its March and May meetings. The timing and number of rate cuts for 2024 now seem less certain.

The Commercial Real Estate Landscape

The commercial real estate sector continues to navigate through challenging market conditions. Rates rose sharply from 2022 to 2023 and have remained elevated. The cost of floating rate debt has increased by more than 500 basis points. The 10-year treasury has risen by approximately 300 basis points and has experienced significant volatility during this period.

There remains a dichotomy between investment firms’ desire to increase their transaction volume and their ability to do so. Commercial real estate transaction volume in the first quarter was down 19% compared to the first quarter of 2023 and approximately 40% compared to the prior quarter.

Valuation gaps remain between buyers and sellers, with buyers underwriting transactions with financing available today and sellers anchored to their cost bases and sale prices previously achieved. A significant amount of institutional capital has been raised to target distressed assets resulting from the sharp rise in borrowing costs. However, these distressed opportunities remain muted as borrowers and lenders continue to work through loan modifications and extensions. From 2022 to 2023, commercial real estate loan modifications increased by 150%. For the most part, owners and lenders are better off extending loans and waiting for a more favorable exit environment than selling assets today.

The rapid rise and volatility of the 10-year Treasury has compounded the challenges of an already difficult financing and underwriting environment. The 10-year Treasury yield increased 30 basis points during the first quarter, and then another 50 basis points in April, for a total of 80 basis points increase in just four months. The elevated and rising 10-year Treasury yield is tempering investment activity and the continued volatility also makes price stabilization harder to achieve.

The Alpha Investing Strategy

Alpha Investing has significantly slowed our transaction pace since the current rate tightening cycle began. Elevated interest rates continue to weigh on transaction volume. While the current operating and transaction environments remain challenged for commercial real estate, we still believe in the medium- to long-term fundamentals, particularly for senior housing and a targeted multifamily strategy.

These asset sectors continue to have favorable supply and demand fundamentals. The aging population in the US is rapidly expanding, driving the demand for senior housing. New construction, however, has been constrained by prohibitively high costs and lack of financing. While multifamily saw significant new supply in 2023, and elevated deliveries are expected through 2025, the number of new building permits issued has declined since 2021, leading to less supply in future years. In the near-term, the wave of new supply will temper occupancy and rent growth. However, the shortage of affordable housing, exacerbated by rising home prices and higher mortgage rates, continues to drive and strengthen the demand for multifamily.

We remain disciplined in our investment criteria seeking to acquire fundamentally sound real estate with outsized upside potential relative to the downside risk. In the current inflationary and high interest rate environment, Alpha Investing has focused on acquisition targets that have maintained an attractive risk/return profile. This includes asset types and strategies that have high in-place yield and durable in-place cash flow, and utilizing fixed-rate financing when available, to offer downside protection. These opportunities are not common in today’s elevated interest rate environment. Most transactions have negative leverage due to how sharply interest rates have risen. Price reductions have not been large enough to offset the impact of higher interest rates. We remain disciplined in our underwriting, focusing on asset fundamentals and downside protection and we will be patient for the right opportunities.

Select opportunities in senior housing have met our investment criteria. We have seen acquisition cap rates in the high single digits. These yields are significantly better compared to other asset types due to the operational intensity and fractured ownership of the sector. These transactions offer strong in-place cash flow with the opportunity to improve yield with an experienced senior housing operator.

We are also evaluating all equity acquisitions for certain investments with durable in-place yield at the right acquisition basis. Acquiring investments with all equity provides downside protection and offers business plan flexibility, including the ability to place financing in the future to return a portion of invested capital.

We remain focused on maximizing value for the investments in our existing portfolio. In most cases, this means holding investments until a more favorable capital markets environment. In an elevated interest rate environment, it is imperative we continue to grow and improve NOI.